RFR Resource Center

Our Deep Regulatory Experience

As the move away from LIBOR to other risk-free reference rates picks up speed, Tradeweb is here to help with the transition. We can draw on our extensive experience with helping clients navigate regulatory reform from Dodd-Frank to MiFID II and beyond.

One Stop for Reference Rate Resources

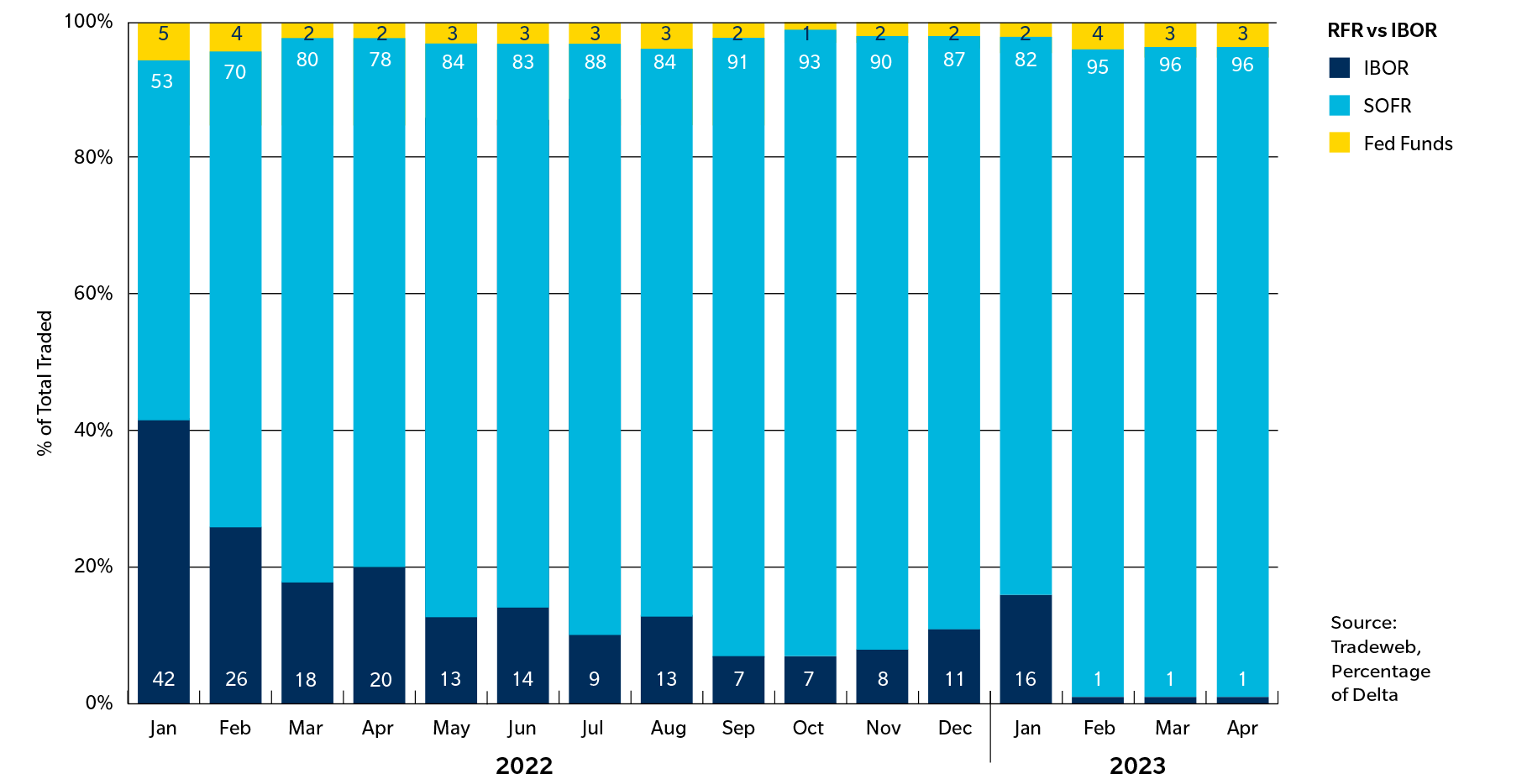

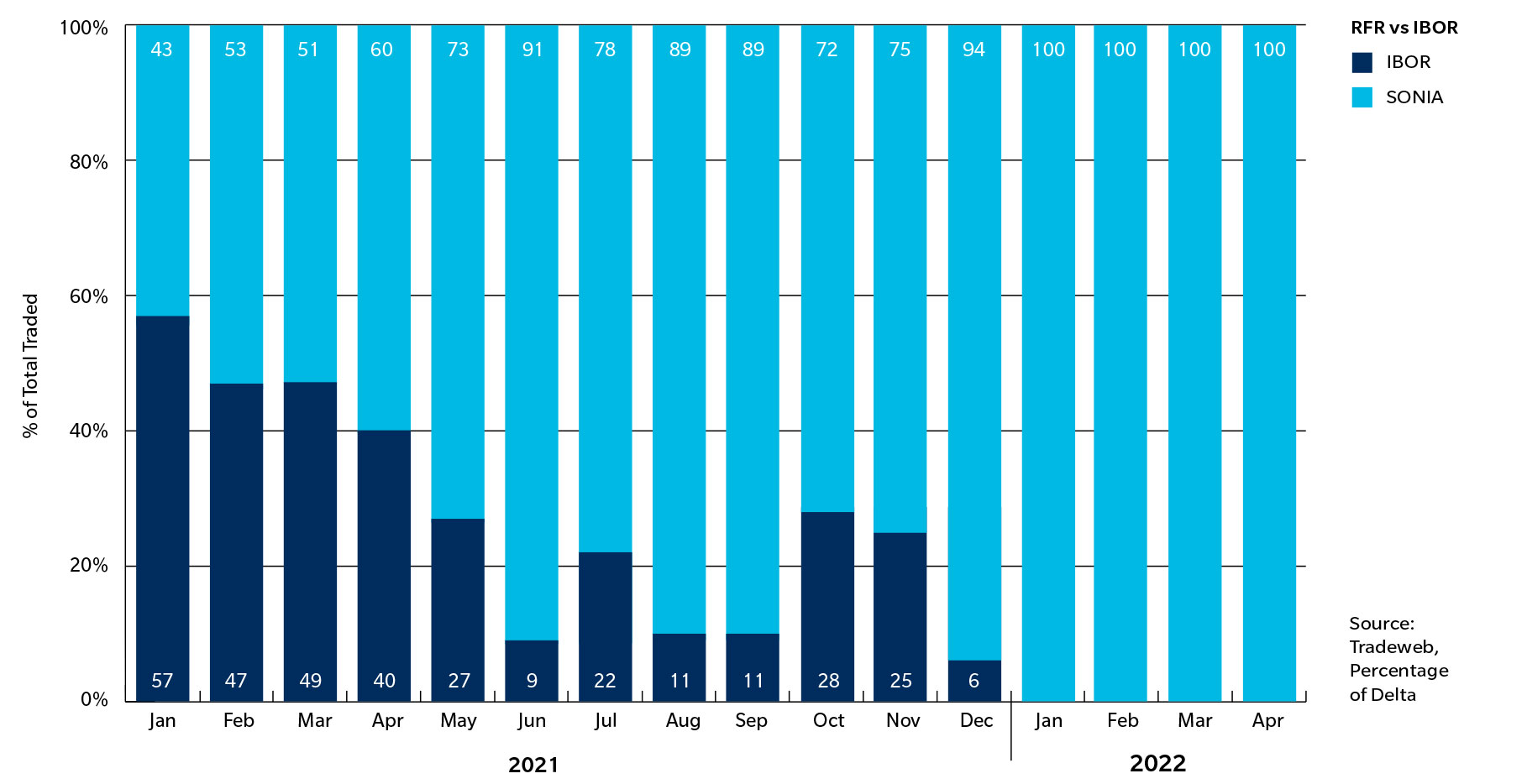

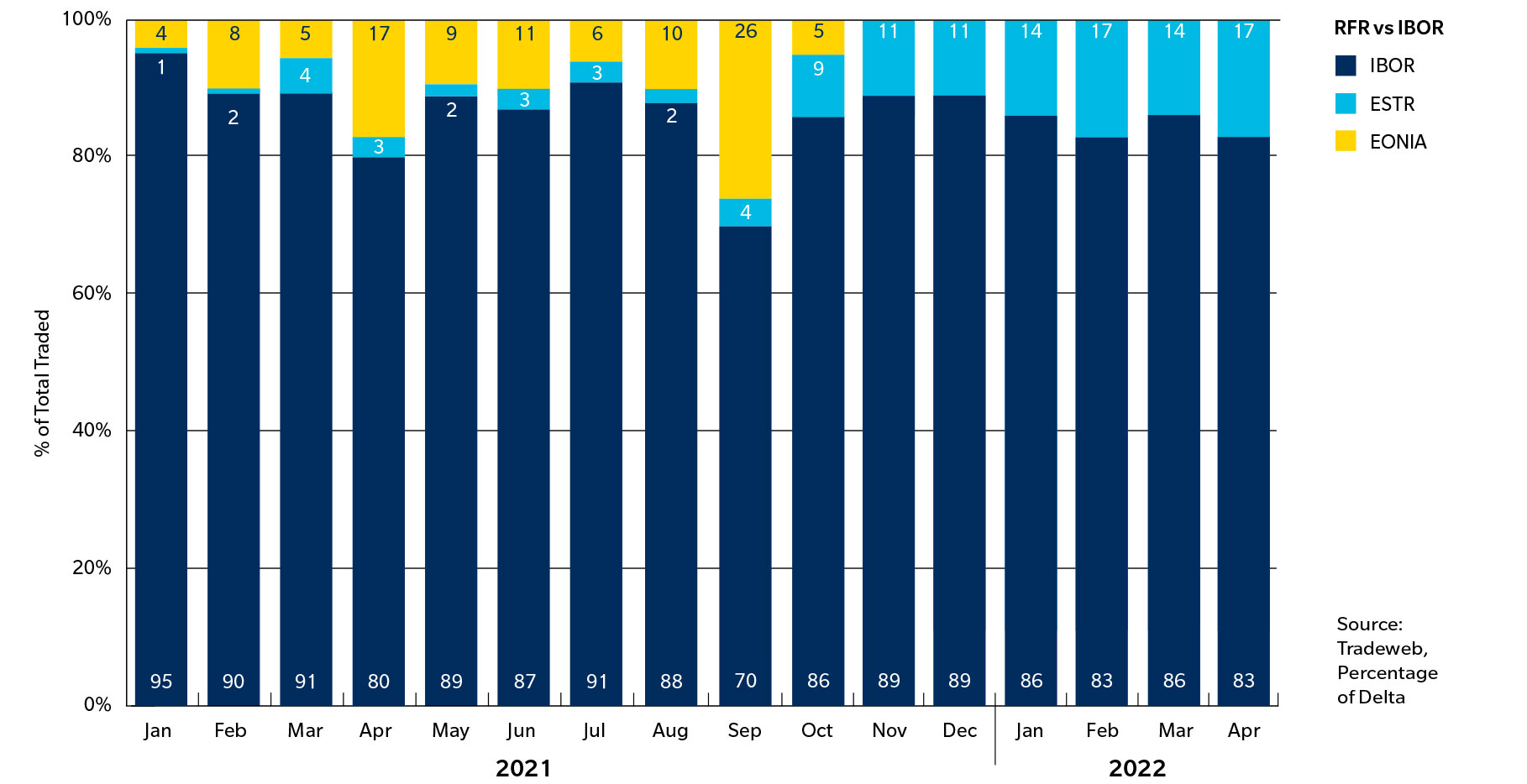

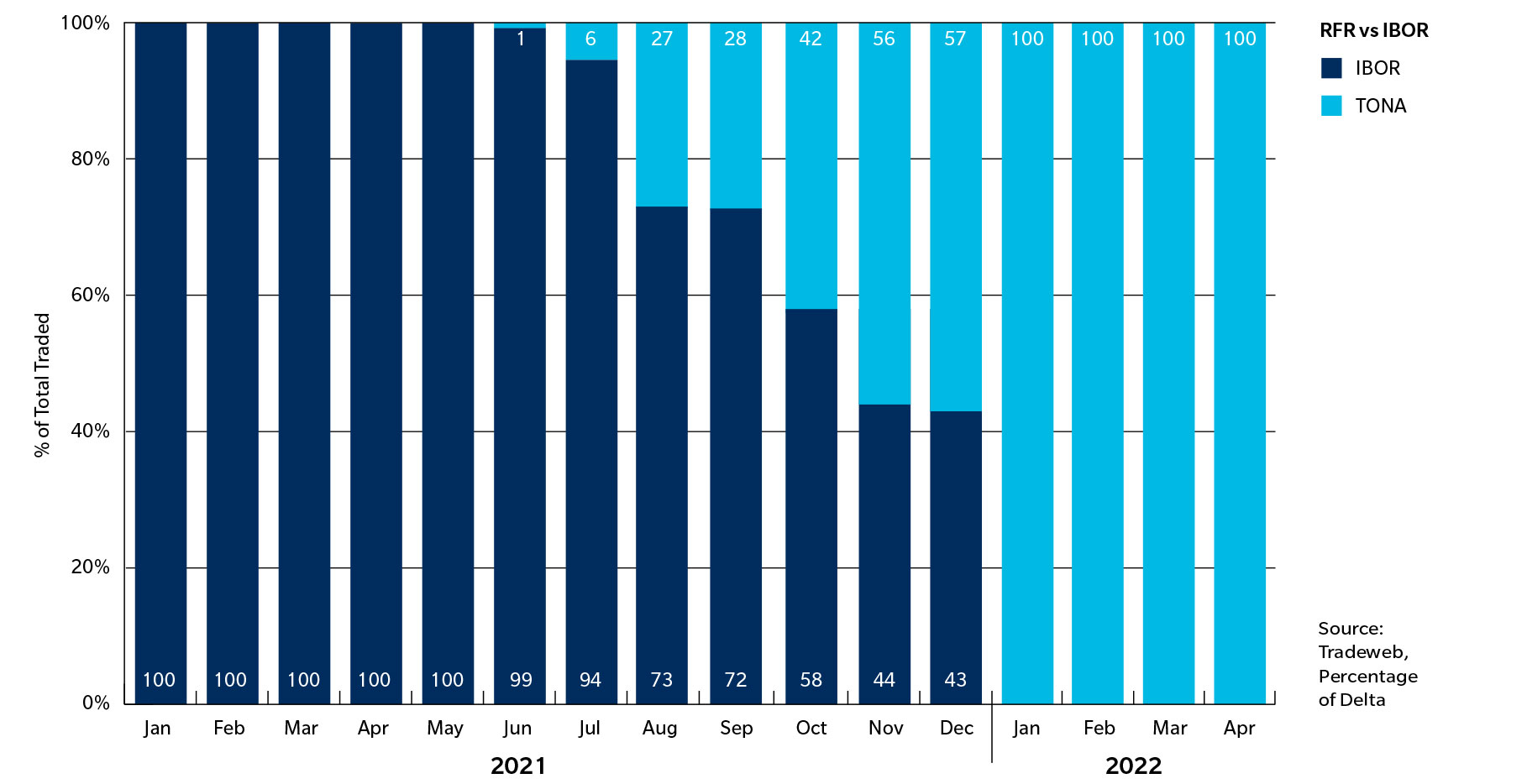

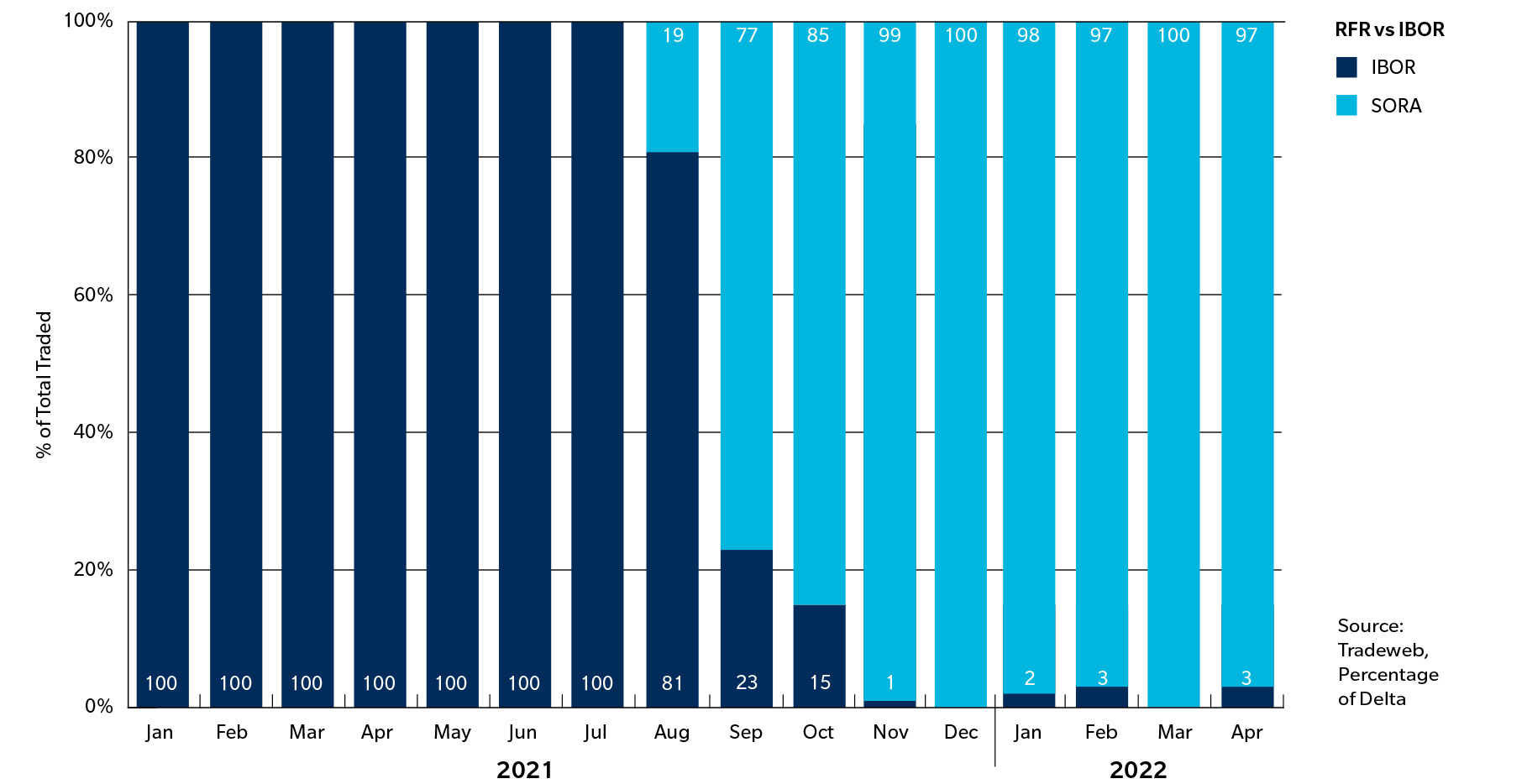

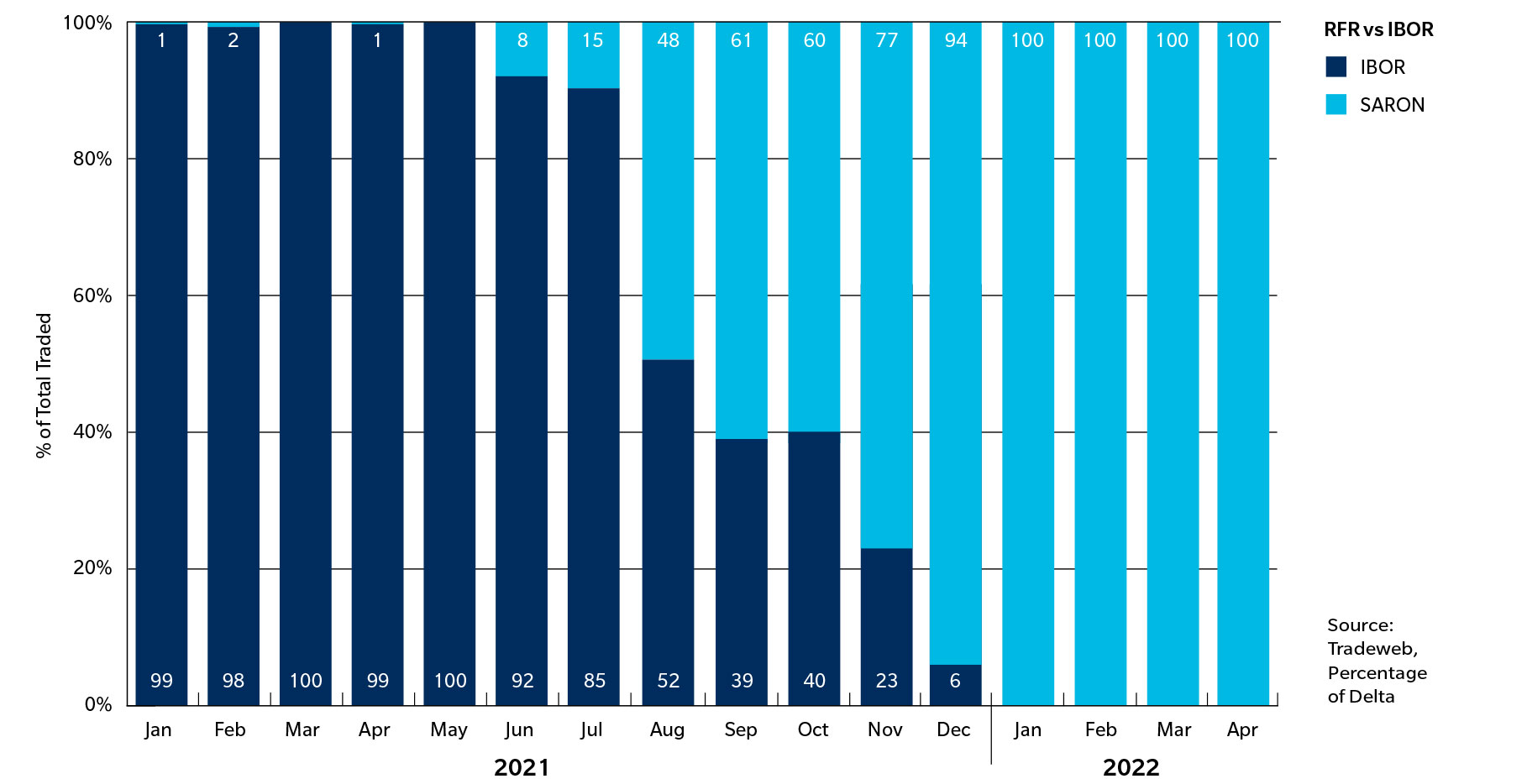

You will find everything consolidated in a single place to help you prepare for LIBOR cessation at the end of 2021 in Europe and Asia, and up to June 2023 in the U.S.. Be sure to check back regularly as we chart the monthly progress of the transition across global currencies and share our latest insights into ways to ensure your readiness.

Transition Progress

Pain-Free Switching

We’re here to help you switch reference rates. Our innovative NPV list trading tool helps easily move cleared interest rate swaps (IRS) positions out of current reference rates such LIBOR or EURIBOR, into the risk-free SONIA ESTR, SOFR, SARON and TONA benchmarks.

The tool also facilitates switching clearinghouse, re-couponing, portfolio compression, compaction, as well as trading multiple asset classes in one list.

REFERENCE RATE SWITCH

EASILY SWITCH BETWEEN INDICES IN THESE CURRENCIES

-

USD

SOFR -

GBP

SONIA -

EUR

€STR -

JPY

TONA -

CHF

SARON -

SGD

SORA

Timeline for Transition

Awards